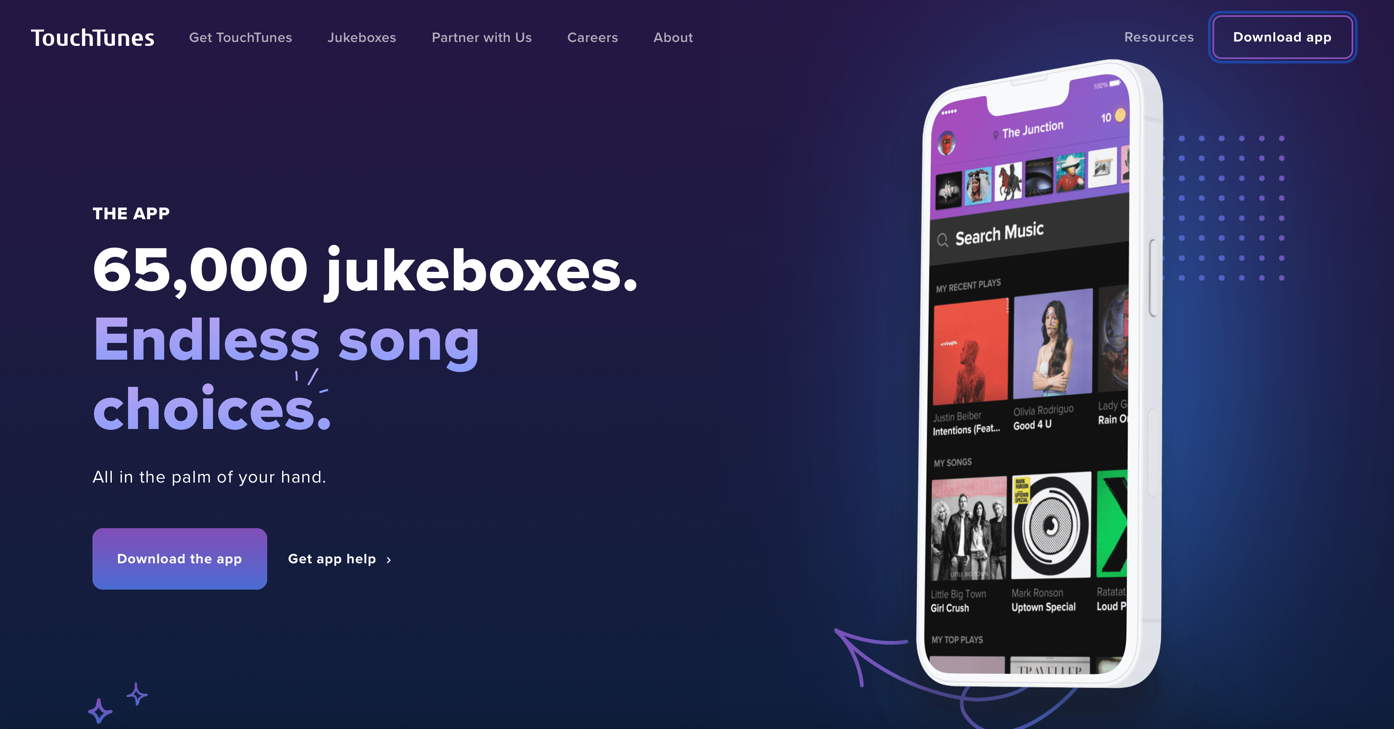

TouchTunes explain the surge in App-Based Payments as the TouchTunes APP sees transformational growth over the last 12 months. With the introduction of Apple and Google Pay to the TouchTunes App payment platform revenues during the back end of 2023 and into 2024 are unparalleled.

A 24-Month Analysis in the UK

Over the past two years, the United Kingdom has witnessed a significant surge in the adoption of app-based payments. As consumers increasingly embrace digital alternatives to traditional payment methods, such as cash and cards, understanding the factors driving this trend and its implications for retail leisure businesses and consumers is essential.

This article aims to help analyse the rise of app-based payments in the UK over the last 24 months, exploring key drivers, trends, and future projections.

1. Growth of App-Based Payments

The use of mobile payment apps has experienced exponential growth in the UK, fuelled by several factors:

- Convenience: Mobile payment apps offer unparalleled convenience, allowing users to make transactions anytime, anywhere, using their smartphones.

- Contactless Technology: The widespread adoption of contactless payment technology has paved the way for seamless mobile payments, eliminating the need for physical cards or cash.

- Pandemic Acceleration: The COVID-19 pandemic acted as a catalyst for the adoption of app-based payments, as consumers sought safer and more hygienic payment methods to minimize physical contact.

- Innovation and Competition: The proliferation of mobile payment apps from various providers, including banks, fintech companies, and tech giants, has intensified competition and spurred innovation in the sector.

2. Key Players and Platforms

Several key players dominate the app-based payments landscape in the UK:

- Apple Pay: Apple’s mobile payment platform, Apple Pay, has gained widespread acceptance among iPhone users and merchants, offering a seamless and secure payment experience.

- Google Pay: Google’s payment platform, Google Pay, provides Android users with a convenient way to make contactless payments using their smartphones.

- Fintech Apps: Fintech companies such as Revolut, Monzo, and Starling Bank offer mobile banking apps with integrated payment functionalities, appealing to the rising number of tech-savvy consumers seeking digital-first banking solutions.

- Retailer Apps: Major retailers and brands, including Starbucks, McDonald’s, and Tesco, have developed their own mobile payment apps, allowing customers to make purchases and earn rewards directly from their smartphones. This is an area that TouchTunes have now developed to help grow their customers revenues through the use of this technology.

3. Consumer Adoption and Behaviour

Consumer and retail customer adoption of app-based payments in the UK has surged, which is driven by several factors:

- Demographic Shift: Younger generations, particularly Millennials and Generation Z, are leading the charge in adopting app-based payment solutions, drawn to the convenience and tech-savvy features offered by mobile apps.

- Security and Trust: Despite initial concerns about security, consumers have grown increasingly confident in the safety and reliability of app-based payment platforms, thanks to robust encryption and authentication measures.

- Multifunctionality: The integration of additional features, such as loyalty programs, rewards, and budgeting tools, into mobile payment apps has enhanced their appeal to consumers, offering added value beyond basic payment functionality.

4. The Future Outlook and Implications

Looking ahead, the rise of app-based payments is expected to continue driven by ongoing technological advancements, shifting consumer preferences, and regulatory developments:

- Continued Innovation: Mobile payment providers will continue to innovate and expand their offerings, introducing new features and services to enhance the user experience and differentiate their platforms.

- Regulatory Landscape: Regulatory developments, such as Open Banking initiatives and PSD2 regulations, will shape the competitive landscape and foster greater interoperability and collaboration within the payment’s ecosystem.

- Consumer Education: As app-based payments become increasingly prevalent, efforts to educate consumers about their benefits, security features, and usage best practices will be essential to ensure widespread adoption and acceptance.

Conclusion

The rise of app-based payments in the UK over the last 24 months represents a transformative shift in the way consumers transact and interact with financial services. As mobile payment apps continue to gain momentum, businesses and financial institutions must adapt to meet evolving consumer expectations and seize opportunities for innovation and growth in the digital payments landscape. By embracing technological advancements, fostering trust and security, and prioritizing customer-centricity, stakeholders can harness the full potential of app-based payments to drive financial inclusion, convenience, and prosperity for all.

If your business would like to explore using the TouchTunes APP as a payment means for your customers, then get in touch we are keen to grow this part of our business work ing with our customers to grow their businesses.